Exploring the Jade Lizard a few weeks back, knowing all along it was simply an iron condor without the downside protection, it was worth considering the successful parameters of other strategies. For example, if one of my Jade Lizard puts is at a strike that also gives me a successful Put Spread, why not combine them? The following real trade will explain.

Methodology (or Pathology)

Regardless of which strategies you want to learn, the No. 1 rule is to learn how to represent it in your own damn spreadsheet. For the three strategies in mine, I only need five out-of-the-money puts and five OOTM calls. With these inputs I create hundreds of scenarios, and hopefully a winning trade.

From those inputs I have tabs of winning Jade Lizards and winning Put Spreads. That has morphed into one all-encompassing Iron Condor tab, which could be all we need.

The Iron Condor sounds a lot sexier than it is. It’s a neutral “set it and forget it” strategy that should expire worthless. Some ambitious traders will open new Iron Condors at earnings, which is often the most volatile time for most high-beta stocks.

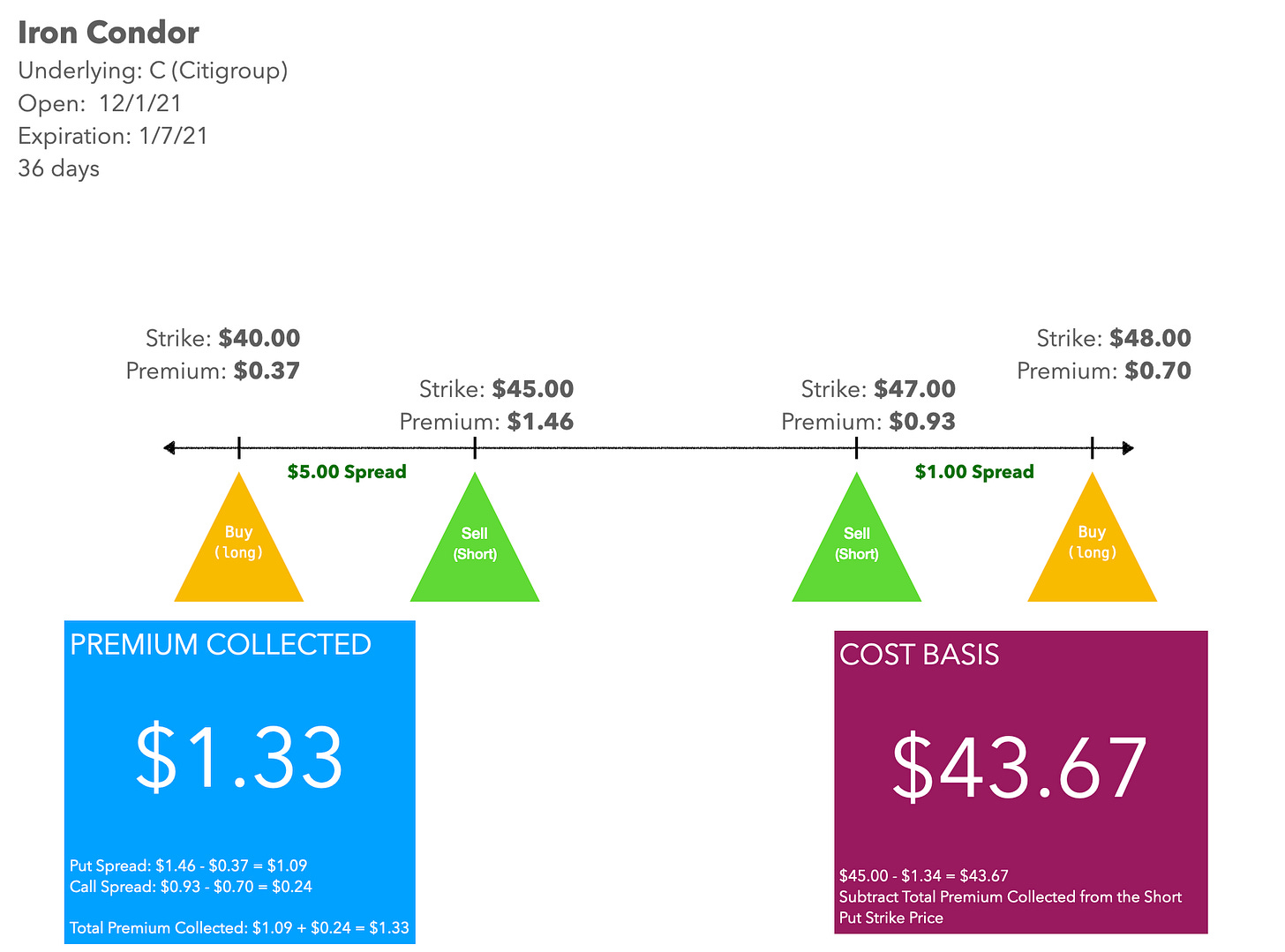

It is a very simple strategy: One Put Spread matched with one Call Spread. In most cases it is most successful when the underlying is between your two short positions at closing. Below is a real example of a Condor I did on one of two bank stocks last week.

I’m not 100% sure of this but I believe some purists will call it a Condor only if you have equal distance between the spreads. When I made the trade, ETRADE didn’t change it to “Custom” as far as I can remember.

In the example above we did a $5.00 Put Spread on Bank of America (BAC) for a premium of $1.09 coupled with a $1.00 Call Spread for an additional $0.24. Total premium collected on this was $1.33 on a $45 bet over 36 days (including weekends).

1.33 ÷ 45 = 0.0295556

ROI = 2.96%

2.96 ÷ 36 = 0.0082

Theta = 0.082

Basically, it’s shy of 3% per month, which means doubling your money every two years.

How We Got Here - Jade Lizard Edition

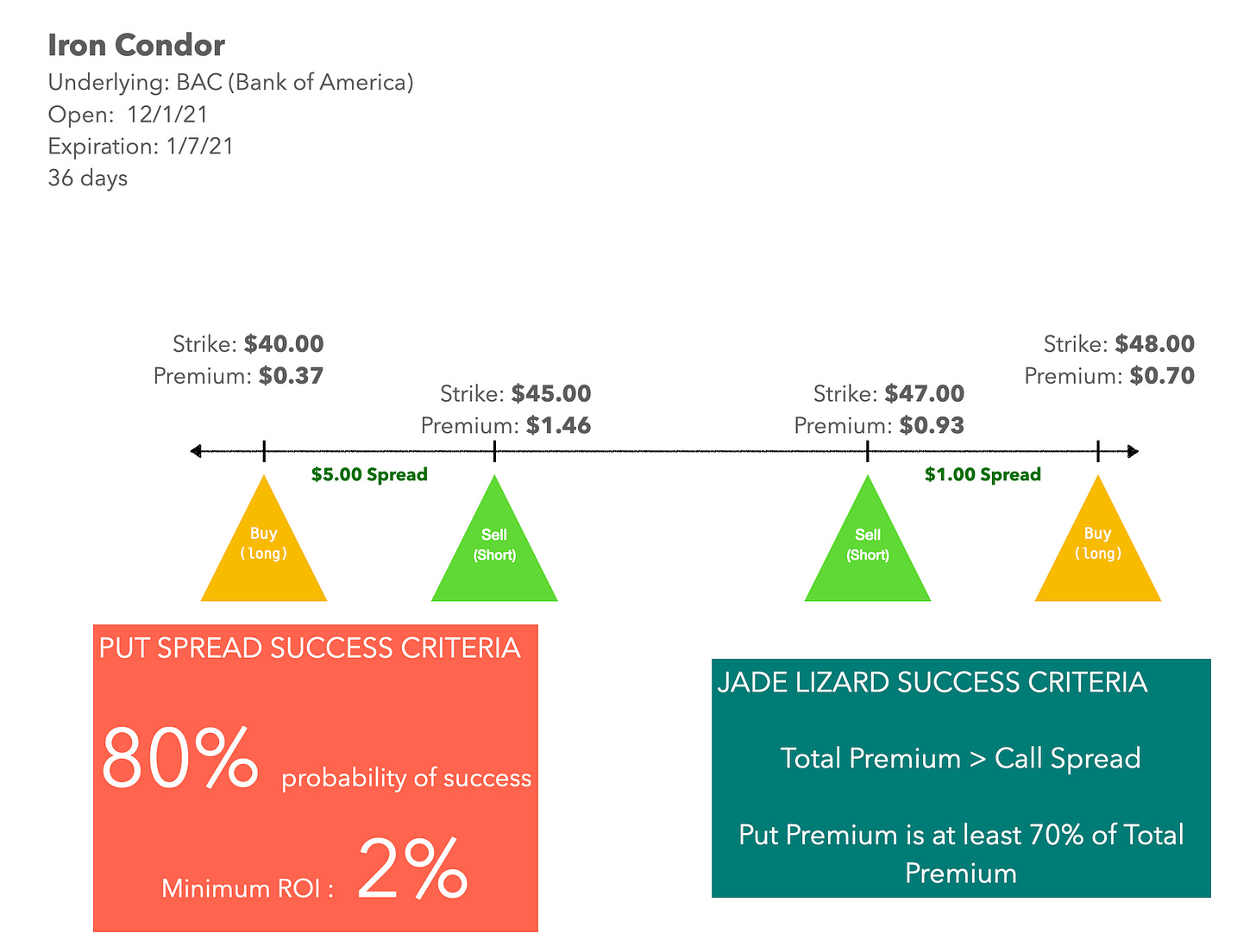

There are two primary formulas for a Jade Lizard:

Total premium must be greater than the call spread

Put premium must be at least 70% of total premium

Regarding the first formula, a call spread loses when the stock price skyrockets through the long call. In the BAC example above, if we only sold a Call Spread at $47/$48, and it closed at $48.01 on January 7, we’d have to buy it at $48 and sell it at $47 for a $1.00 loss. But, if we collected more than $1.00 in premium, then we won’t lose on the upside.

So, returning to the spreadsheet, we eliminate any scenario that does not fit both of the above formulas.

How We Got Here - Put Spread Edition

The simple formula for success probability in Put Spreads is:

1 - (Premium ÷ Spread)

To that end, I set a minimum of 80%. This means there is an 80% probability that the trade will make at least $0.01; it does not mean it’s 80% likely to close out of the money.

I also use the Put Spreads to drive my ROI. So in evaluating all scenarios, consider return on investment over time. For longer term option spreads (in my world 30 - 45 days) these ROIs need to be much higher than when you’re playing weekly spreads.

Because this was a monthlong contract, I set a minimum of 2% ROI.

Here’s What Went Down

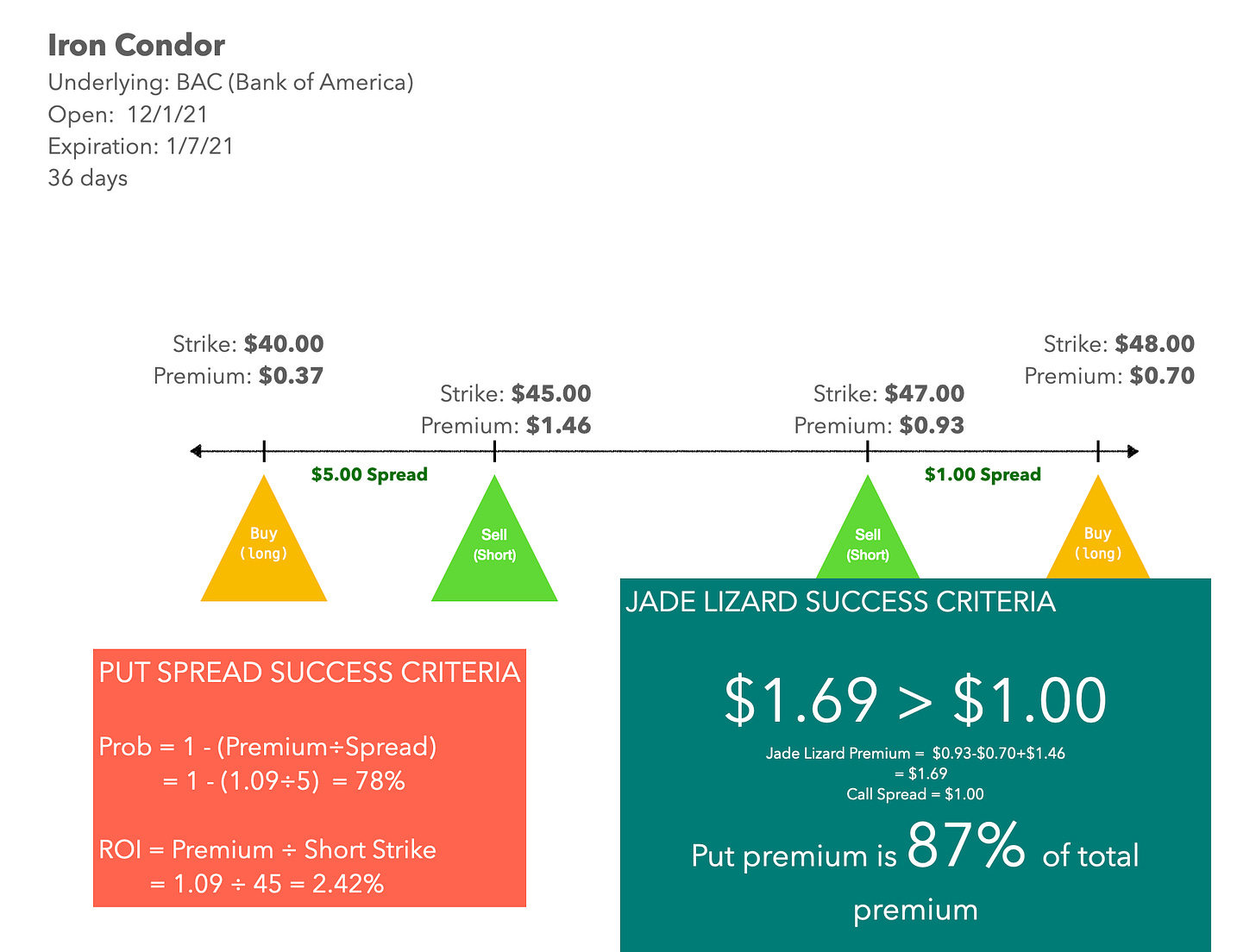

When populating my spreadsheet I use Last Price form Yahoo! Finance. Some of these are not very accurate, and this explains why my trade ultimately had a 78% probability of success.

Other than being 2% below my probability goal, if BAC closes between $45 and $47 on January 7 I’ll make 2.45% just on the Put Spread. From the Jade Lizard side, if I had done this trade without the long put (thus turning it into an Iron Condor), it would have netted $1.69 in premium, which is way above the $1.00 Call Spread. The put premium, at $1.46 is 87% of the total, which in this case is $1.69.

The Final Condor

We collected $1.33 on a $45 bet, which is the strike price of our short put. That is a 2.96% monthly return. If the stock price breaks through on the high end ($48) we still make 0.73%. If it collapses under the long put ($40), we could lose $3.67 on a $45 bet, which is 8.16%.

Again… If you understand this, make your own spreadsheet.